Modernizing India's Payment Systems: Exploring Central Bank Digital Currencies (CBDCs)

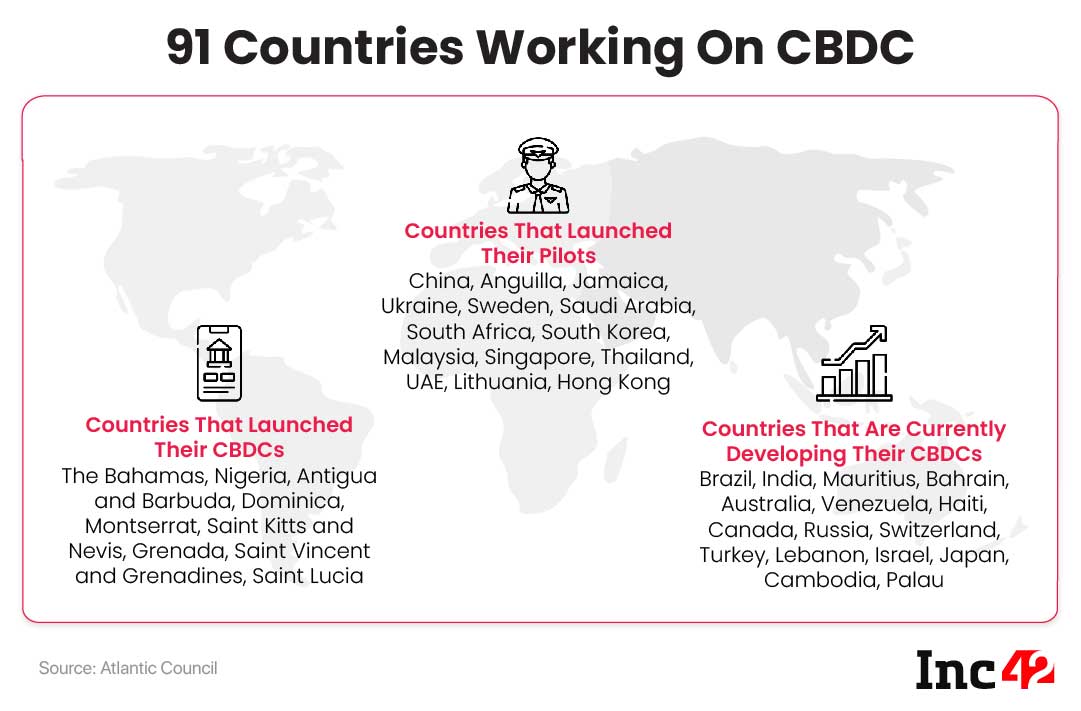

In a rapidly digitizing world, where financial transactions are increasingly conducted online, the Reserve Bank of India (RBI) is taking significant steps towards modernizing India's payment systems. One of the most groundbreaking initiatives on the horizon is the exploration of Central Bank Digital Currencies (CBDCs). This move aims to revolutionize the way transactions are conducted, particularly in international trade, while also addressing various challenges associated with traditional settlement mechanisms.

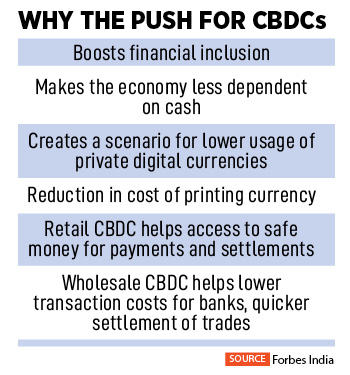

The recent focus of the RBI has been on leveraging CBDCs to facilitate instant and direct transactions between Indian importers and foreign exporters. By doing so, the reliance on external systems, such as the US Federal Reserve, for settlement purposes can be reduced, thus mitigating currency settlement risks. This strategic shift underscores India's determination to assert greater control over its financial infrastructure and reduce dependency on external entities.

Although the RBI has publicly stated that it is not rushing to implement a full-scale, retail CBDC and has refrained from providing a specific timeline, recent developments suggest a quiet sense of urgency. Since late 2022, the RBI has been actively advocating for the adoption of both wholesale and retail CBDCs. The retail CBDC, in particular, has witnessed a significant milestone, with a million transactions recorded in a single day, signaling a burgeoning interest and potential for widespread adoption.

Furthermore, the RBI's openness to involving startups in its CBDC pilot programs indicates a willingness to embrace innovation and collaboration in shaping India's digital currency landscape. Additionally, the exploration of technology to address privacy risks associated with CBDC usage underscores the RBI's commitment to safeguarding the interests of its citizens while embracing technological advancements.

The introduction of the Digital Rupee, envisioned as a tokenized digital version of the Indian Rupee, marks a pivotal moment in India's journey towards a more efficient and inclusive financial ecosystem. By harnessing the potential of CBDCs, India aims to support its burgeoning digital economy, reduce the costs associated with physical cash management, and create a more efficient monetary payment system.

Moreover, CBDCs have the potential to significantly enhance financial inclusion by providing access to formal financial services for millions of unbanked and underbanked individuals across the country. Through innovative approaches and strategic partnerships, the RBI is laying the groundwork for a more inclusive and accessible financial infrastructure.

In conclusion, the RBI's cautious approach and ongoing exploration of CBDCs reflect a strategic and forward-thinking stance in the evolution of India's digital currency landscape. By embracing innovation while prioritizing security and inclusivity, India is poised to emerge as a global leader in the realm of digital payments. As the journey towards modernizing India's payment systems continues, the adoption of CBDCs holds immense promise in shaping a more resilient, efficient, and inclusive financial future for the nation.

Comments

Post a Comment